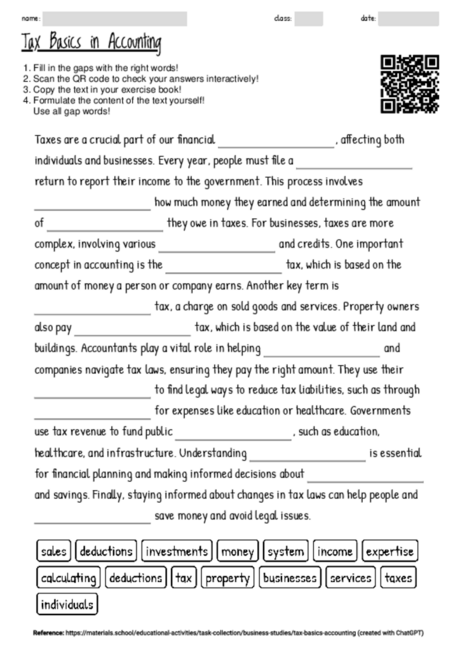

Tax Basics in Accounting

Cloze texts, like the one on taxes in the context of accounting, serve as effective educational tools by engaging students in active learning. By filling in the blanks, students must recall specific terminology and concepts, reinforcing their understanding of the subject matter. This particular text provides a foundational overview of taxes, highlighting their importance in both personal and business finances. It encourages learners to connect theoretical knowledge with real-world applications, such as the role of accountants in tax planning and the impact of taxes on financial decisions. The selection of keywords ensures a focus on critical aspects of the topic, facilitating a deeper comprehension of how taxes function within the broader economic system. By integrating this cloze text into teaching, educators can assess students' prior knowledge, identify misconceptions, and stimulate discussion on the complexities of tax systems. Moreover, the activity can enhance reading comprehension and analytical thinking, essential skills in both academic and everyday contexts. Lastly, discussing the correct answers collectively can further clarify concepts and encourage collaborative learning.